Luxury Fund Managers

3 Minute Read

Top 5 Luxury Customer Trends for Luxury Fund Managers

14th February 2024

1.

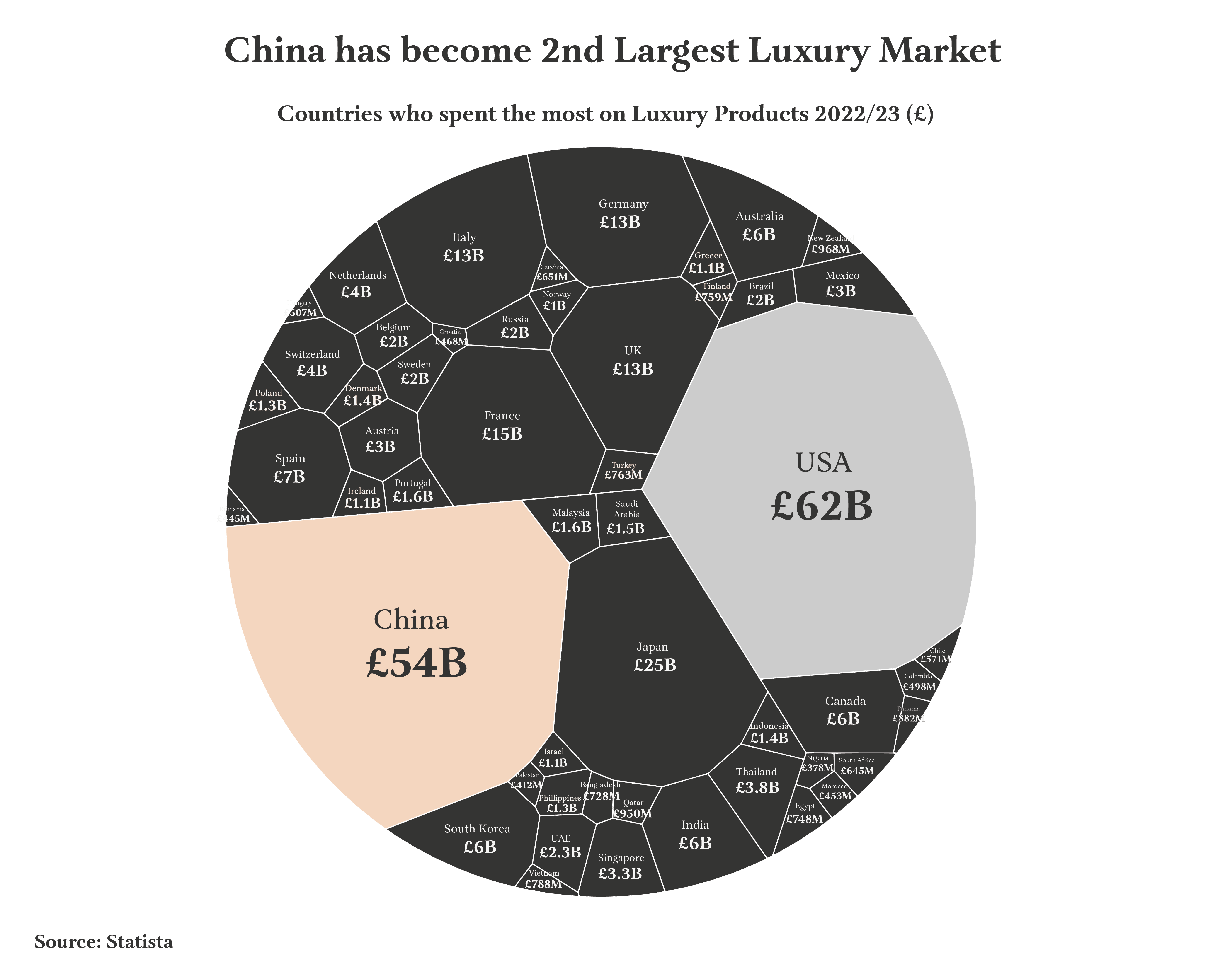

China became the second biggest luxury market in 2023 and luxury’s leading brands success or failure is increasingly dependant on their performance in this market.

Chinese luxury customers spent more than customers in the top four countries in Europe (France, Germany, Italy, United Kingdom) combined in 2023.

2.

Chinese luxury customer spending behaviour changed in 2023.

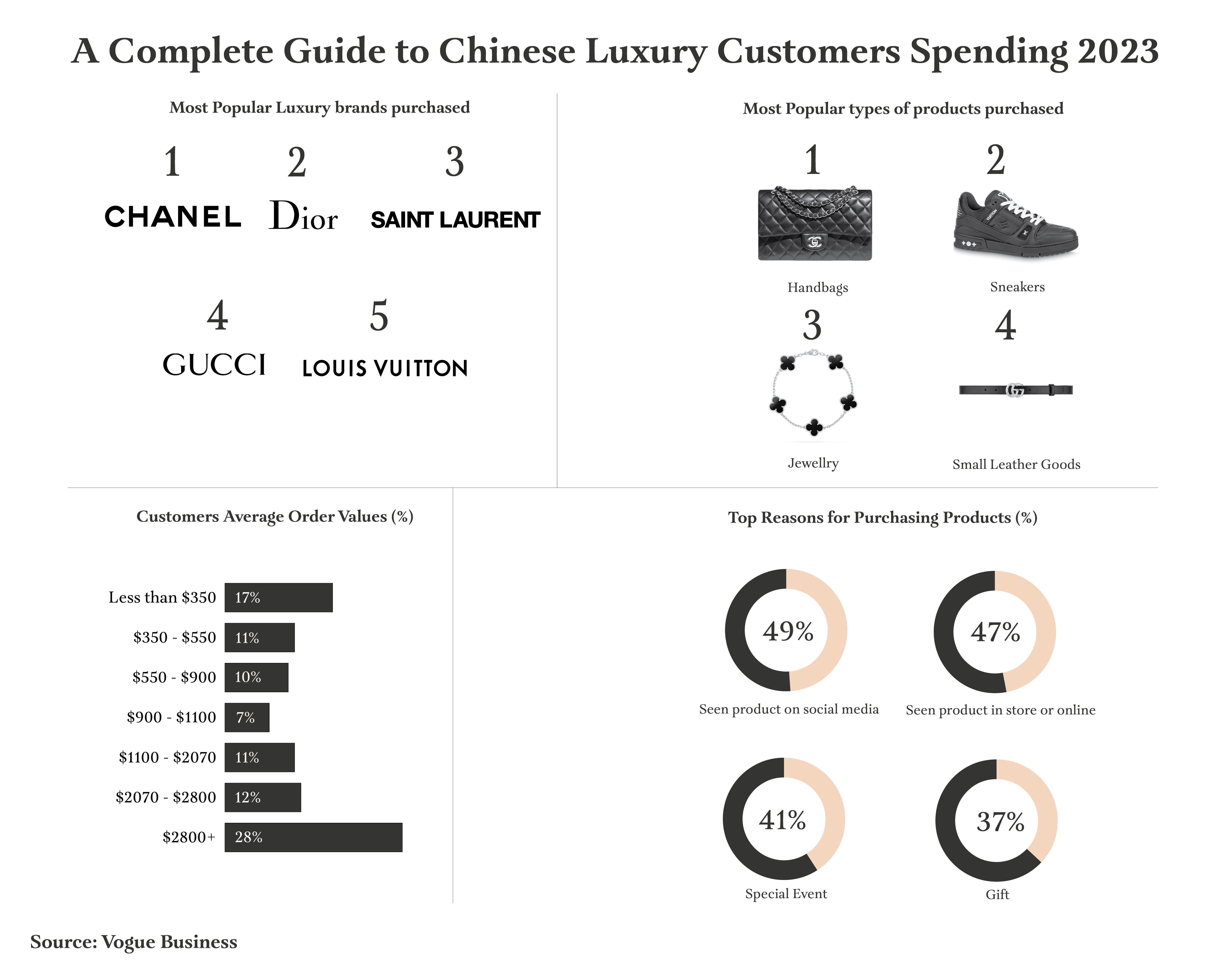

With almost 30% of luxury chinese customers having spent $2,800 or more on luxury products in 2023.

The top luxury brands are still their favourite.

Chanel is now the most popular and Kering owned Saint Laurent is now in the top three most purchased brands by chinese luxury customers.

Luxury sneakers , which are 50% of global luxury ecommerce sales , are now the second most purchased item by luxury chinese customers in 2023.

Seeing products on social media, instore or online are still the main reasons for purchase.

'Self Gifting' whereby customers purchase gifts for themselves is becoming more popular.

3.

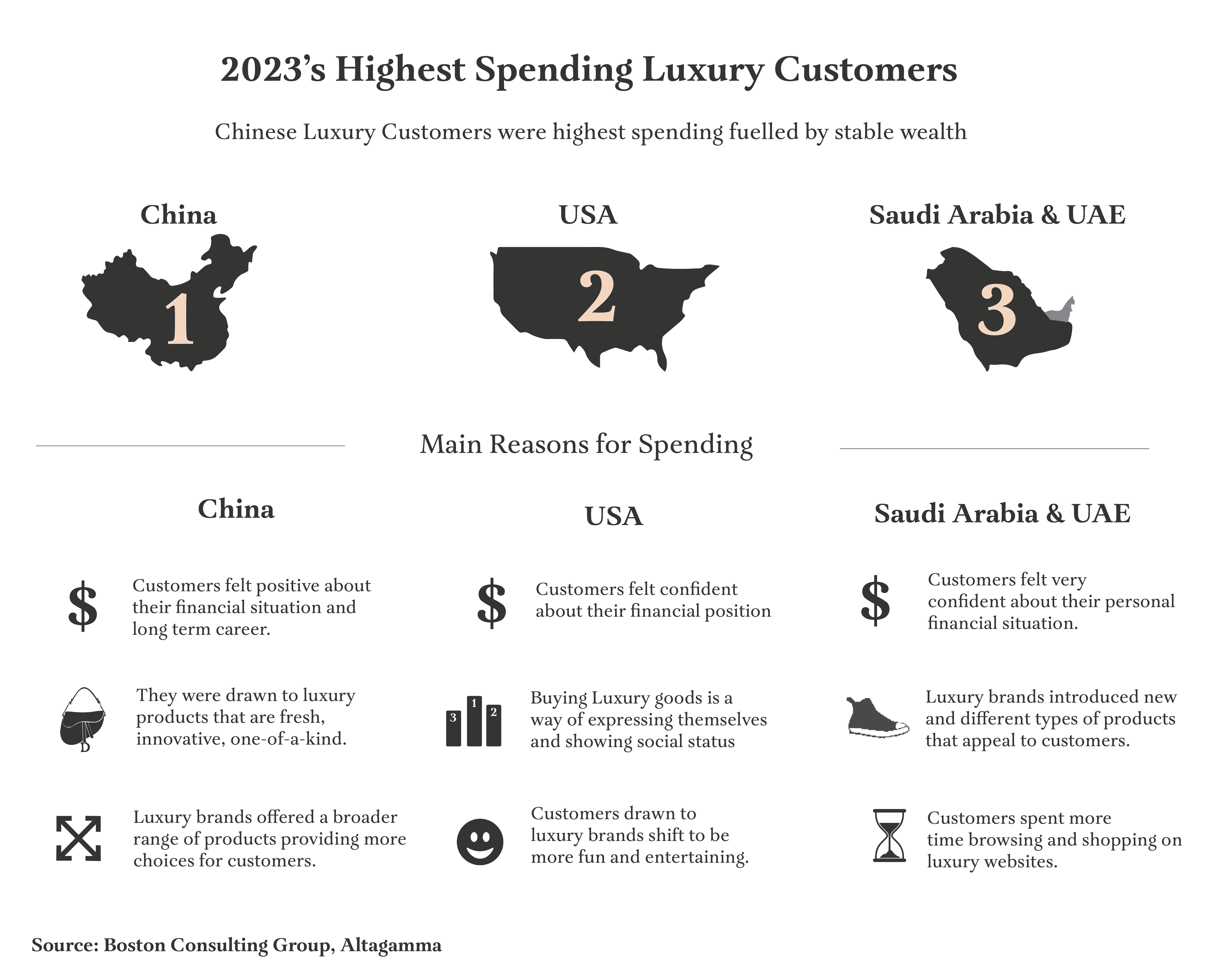

Luxury's highest spending customers ,who spend on average £39K+ a year on luxury products in 2023 were chinese luxury customers.

60% of luxury's highest spending customers became wealthier in 2023 which is why they spent more or the same as 2022.

Limited edition cultural themed products and innovative one of a kind products were in high demand.

New and different types of products like luxury resale also appealed to luxury's highest spending customers.

Saudia Arabian and UAE top spending luxury customers are increasingly spending less time shopping in malls (the most popular point of sale in that market) and purchasing online.

American top spending luxury customers are drawn to luxury brands that are fun and entertaining.

Many luxury brands success in 2023 was due to acquiring and keeping luxury's top spenders. 2024 is likely to be similar.

4.

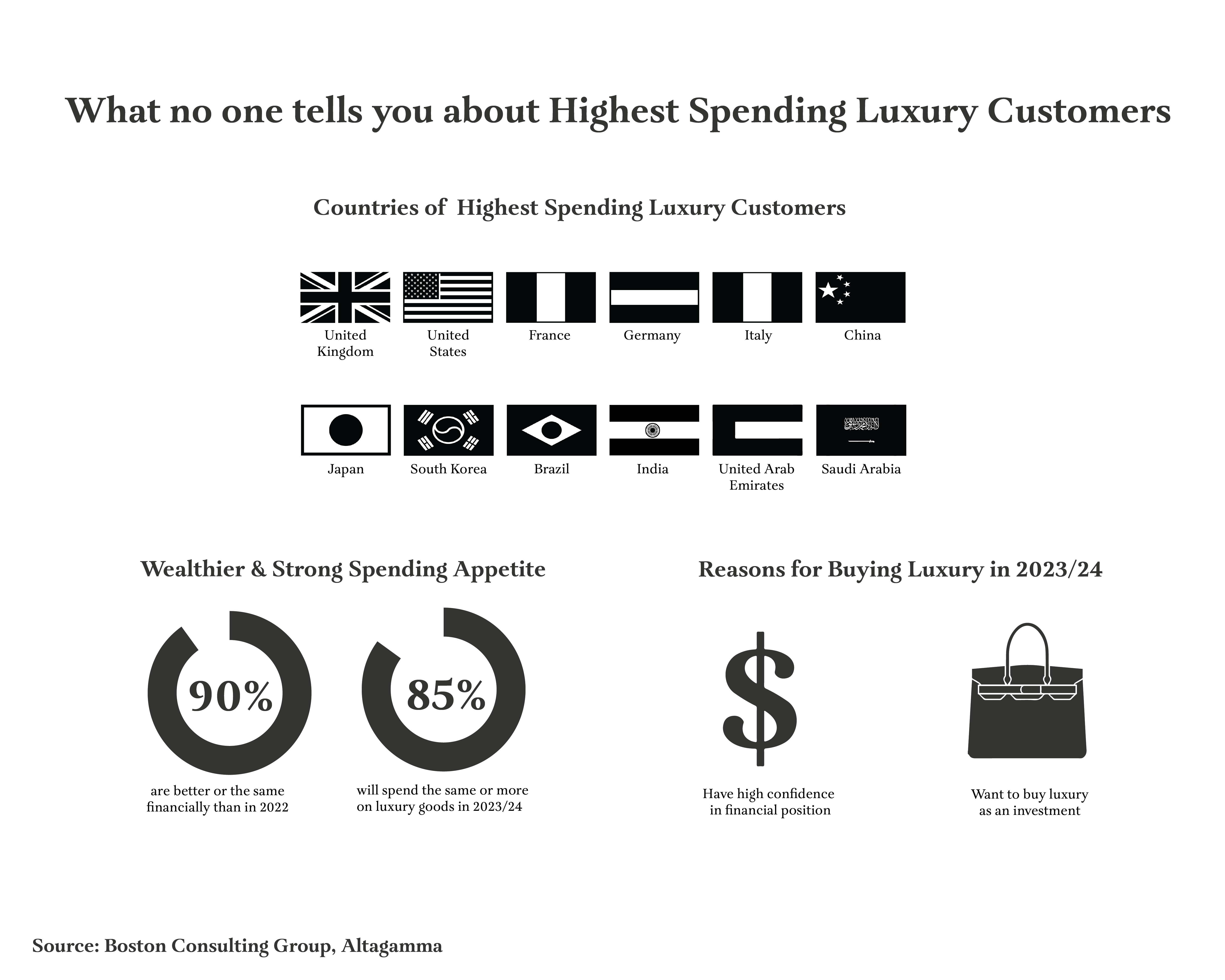

Luxury’s highest spending customers don’t just purchase.

Increasingly they are purchasing luxury products as a financial investment to resell.

Some Luxury handbags and sneakers that are resold have provided better returns than gold, real estate and the stock market.

Auction houses like Bonhams, Christie's and Sotheby's have recently started to auction pre-owned handbags and luxury sneakers making it easier to resell very high priced products.

Much like art, wine and classic cars.

Luxury's highest spending customers no longer just purchase luxury products they invest in them.

5.

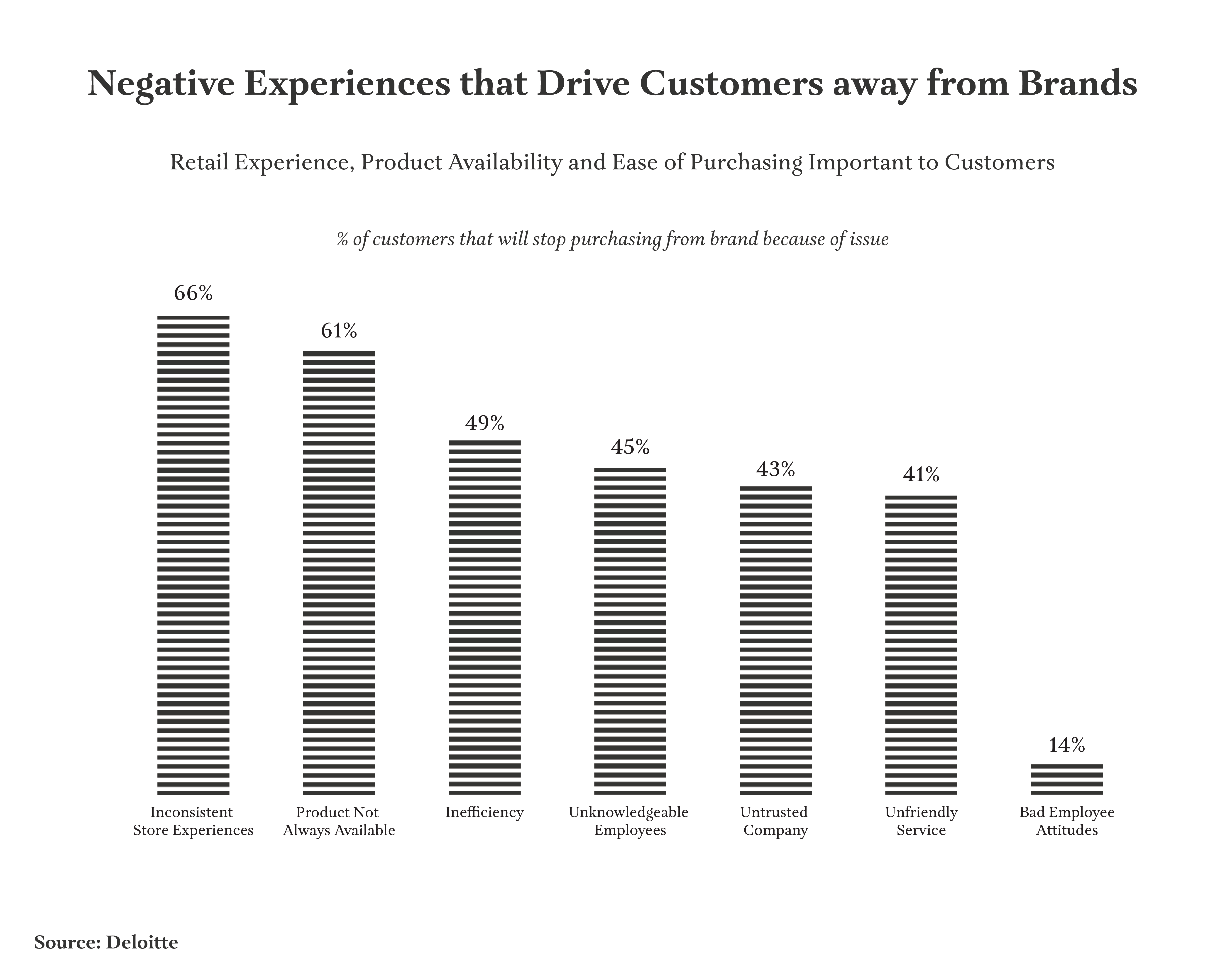

Luxury customers want a great experience in-store and online.

2024 will be no different.

Negative Customer Experiences are Expensive

1 in 3 customers will stop purchasing from a brand if they have just one negative experience.

Customers will tell 9 people on average about a positive customer experience.

They will tell on average 16 about a negative one.

Speed and Convenience

Luxury ecommerce customers don't like their time being wasted and they will love the experience if you 'don't make them think' or make purchasing frictionless or fast and easy.

This is why inefficiency in customer experience like poor performance with delivery, checkout, product availability are in the top 3 reasons customers stop purchasing from a brand.